All About San Diego Home Insurance

Secure Your Assurance With Reliable Home Insurance Coverage

Why Home Insurance Is Necessary

The value of home insurance lies in its capability to give financial security and assurance to home owners despite unexpected events. Home insurance coverage functions as a safety and security net, providing protection for damages to the physical structure of the home, personal possessions, and obligation for mishaps that may happen on the home. In the event of natural disasters such as floodings, fires, or quakes, having a comprehensive home insurance coverage can help property owners recover and rebuild without dealing with considerable monetary burdens.

Moreover, home insurance is often called for by home mortgage loan providers to safeguard their investment in the property. Lenders desire to make sure that their financial passions are guarded in instance of any type of damage to the home. By having a home insurance coverage in place, home owners can meet this need and secure their financial investment in the residential or commercial property.

Sorts Of Protection Available

Given the relevance of home insurance policy in safeguarding home owners from unforeseen economic losses, it is crucial to comprehend the different sorts of insurance coverage readily available to tailor a policy that suits individual requirements and scenarios. There are numerous vital kinds of coverage offered by many home insurance coverage policies. The very first is home coverage, which safeguards the structure of the home itself from risks such as fire, vandalism, and natural calamities (San Diego Home Insurance). Individual residential or commercial property coverage, on the other hand, safeguards possessions within the home, including furniture, electronics, and garments. If someone is injured on their building, responsibility insurance coverage is crucial for securing property owners from medical and lawful costs. Additional living expenses insurance coverage can assist cover costs if the home comes to be uninhabitable due to a protected loss. It is very important for homeowners to very carefully evaluate and recognize the different kinds of coverage available to guarantee they have sufficient defense for their particular demands.

Factors That Influence Premiums

Variables influencing home insurance coverage costs can differ based on an array of factors to consider certain to private situations. Older homes or buildings with outdated electrical, pipes, or heating systems might present higher threats for insurance policy business, leading to higher premiums.

Additionally, the insurance coverage limitations and deductibles chosen by the insurance holder can impact the costs amount. Going with higher coverage limitations or lower deductibles normally results in greater premiums. The kind of building materials utilized in the home, such as wood versus brick, can also impact premiums as certain products may be much more prone to damages.

Just How to Pick the Right Plan

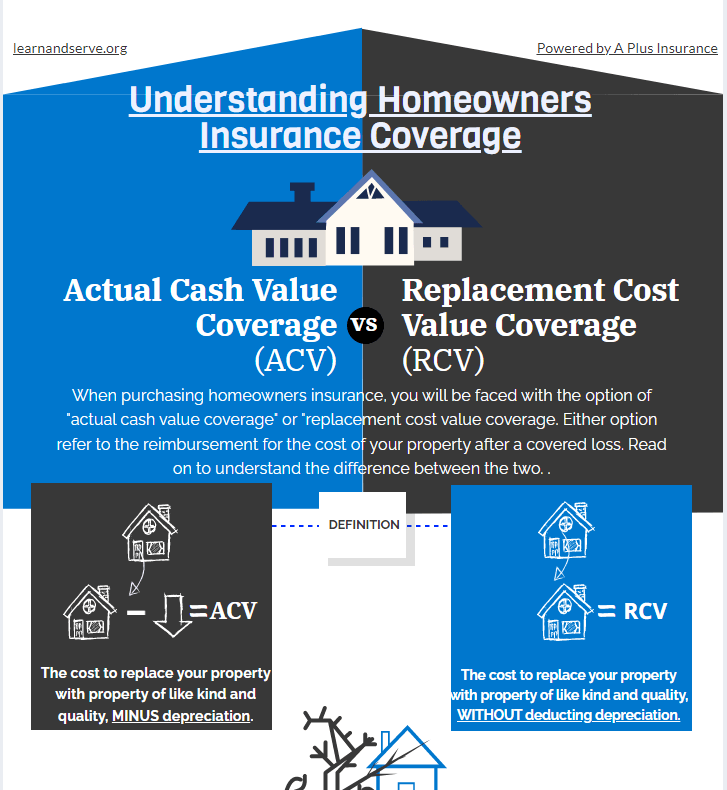

Choosing the suitable home insurance policy entails mindful consideration of numerous vital elements to guarantee extensive coverage customized to private needs and circumstances. To start, assess the value of your home and its materials precisely. Understanding the substitute expense of your home and possessions will aid figure out the protection restrictions needed in the plan. Next, consider the various sorts of insurance coverage offered, such as home insurance coverage, personal residential property protection, liability security, and additional living costs coverage. Dressmaker these coverages to match your certain needs and danger aspects. In addition, evaluate the plan's deductibles, exclusions, and restrictions to guarantee they align with your economic capacities and risk resistance.

In addition, evaluating the insurer's online reputation, economic stability, consumer solution, and asserts procedure is vital. Search for insurance firms with a history of reputable service and prompt insurance claims settlement. Compare quotes from numerous insurance providers to find a balance in between price and coverage. By meticulously reviewing these variables, you can pick a home insurance plan that provides the needed defense and comfort.

Advantages of Reliable Home Insurance

Dependable home insurance policy supplies a complacency and defense for property owners versus economic losses and unanticipated events. Among the essential benefits of dependable home insurance is the assurance that your residential or commercial property will be covered in case of damages or devastation best site brought on by all-natural calamities such as tornados, fires, or floods. This insurance coverage can help homeowners prevent birthing the full cost of repairs or rebuilding, giving satisfaction and economic security during tough times.

Additionally, trusted home insurance plan often consist of liability security, which can protect property owners from medical and legal expenditures when it comes to mishaps on their property. This coverage expands beyond the physical structure of the home to safeguard against legal actions and cases that may emerge from injuries endured by site visitors.

In addition, having reputable home insurance policy can also add to a feeling of total health, knowing that your most considerable financial investment is guarded against different threats. By paying routine premiums, home owners can reduce the potential economic burden of unexpected occasions, enabling them to concentrate on enjoying their homes without continuous bother with what More Help might occur.

Verdict

Finally, safeguarding a dependable home insurance plan is important for protecting your home and possessions from unexpected events. By understanding the sorts of protection available, elements that influence costs, and exactly how to choose the ideal policy, you can guarantee your comfort. Relying on a reliable home Full Report insurance coverage service provider will certainly supply you the advantages of monetary defense and security for your most important property.

Navigating the realm of home insurance coverage can be intricate, with numerous protection choices, policy elements, and considerations to evaluate. Understanding why home insurance policy is important, the kinds of insurance coverage readily available, and exactly how to choose the ideal plan can be essential in ensuring your most substantial investment remains safe and secure.Given the relevance of home insurance policy in protecting homeowners from unexpected economic losses, it is important to understand the different types of insurance coverage available to tailor a plan that suits private demands and conditions. San Diego Home Insurance. There are numerous vital kinds of coverage offered by most home insurance policy policies.Choosing the proper home insurance plan entails careful factor to consider of different crucial elements to make certain extensive insurance coverage tailored to individual demands and situations